- There are around 23,000 payday lenders across the United States

- An estimated 6% of adult Americans have taken out a payday loan in the last 5 years

- Payday lending costs the United States about $7 billion annually

Payday loan stores are becoming the new lifeline for many. Life is full of unexpected moments and payments that a monthly paycheck may not cover. As such, many are looking to payday loans to tide them over until their next paycheck. Be it an unexpected bill or an emergency payment, these loans can provide immediate access to funds which you can pay back when you receive your next pay day.

The Growing Market of Payday Loan Stores in the US

Payday loans are increasing in popularity across the US. According to recent data from California State University, there are twice as many payday lenders as there are McDonald’s in the United States – that is a grand total of around 23,000 payday lenders.

It is estimated that around 6% of adult Americans have opted for a payday loan at some point in the last five years. This is particularly an emerging market for a younger target audience; in fact, the majority of that 6% are between 18 to 24 years old. Americans spend around $4 billion annually in payday loans fees. The market of payday lending costs about $7 billion, accommodating 12 million borrowers, in the United States annually.

In the United States, there are twice as many payday lenders as there are McDonald’s

Why Choose a Payday Loan?

With many living from paycheck to paycheck, more people are looking for online payday loans or other solutions. Data suggests that 40% of Americans do not have $400 to cover an emergency expense that may arise. It is not surprising that, for many, payday loans, offer a convenient solution.

A survey carried out in 2018 by CNBC showed that 51% of Millennials have considered a payday loan at some point and 40% of 18-21 year olds. Whilst payday loans can be beneficial for unexpected and emergency expenses, research also shows that many rely on them for ongoing costs. These can include things like student loans or daily transportation costs. In fact, a 2012 study showed that 69% of payday loan borrowers were using the loans for a recurring expense.

Who are Payday Loan Stores for?

Statistics show that those earning under $40,000 annually are the most likely to choose a payday loan. The study also highlighted that the younger population, African Americans, renters, people who are separated or divorced and those without a college education are also most likely to use payday loans. Payday loans tend to be available for anyone over the age of 18 years old, who earn a minimum of $800 monthly and can prove future repayment.

Where are Payday Loan Stores in the United States?

There are currently many payday loan stores across the United States. However, it should be noted that payday loans are outlawed in certain states. Payday loans are still prohibited in Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, West Virginia and the District of Columbia.

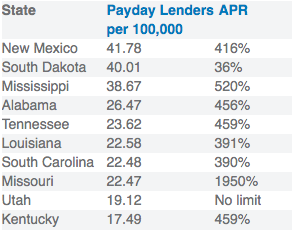

The top ten states with the highest number of payday lenders per 100,000 (creditrepair.com)