- Laws regarding payday loans vary from state to state

- Payday lenders are explicitly banned in 10 states

- If payday loans are illegal in your state, there are other options available for borrowing

How Do Payday Loans Vary Between States?

When considering a payday loan, the most important thing to check is whether they are legal in your residing state. Currently, there are ten states (plus the district of Columbia) which prohibit payday loans. Across the 40 states that permit payday loans, there is unique regulatory data per state. Across these states, there is a huge level of variability between interest rates, ranging from 36 to 1950%. This is due to some states issuing a price cap. Typically, there is a higher concentration of payday lenders in the states in which the regulations are more lax.

Are Payday Loans Legal in my State?

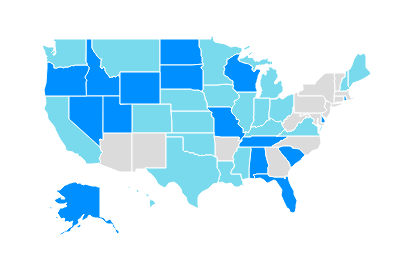

Map showing the legality of payday loans across states (Dark Blue = Legal; Light Blue = Heavily Regulated; Grey = Prohibited) (finder.com)

Although payday loans are legalized in the majority of states (including California and Texas), there are many regulations across certain states including price caps of interest rate. Payday loans are prohibited in Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, West Virginia and the District of Colombia.

How Can I Tell if a Payday Lender is Licensed in my State?

When taking out a payday loan, you should always check that a lender is licensed. You can ask to see a state-issued license. This is usually readily available either via their website or as a physical copy in a payday loan store. You can also go one step further and verify the license with a financial regulations office or with your state attorney general.

Can I Get A Payday Loan Across State?

Depending on your situation, you may be able to get a loan if you are temporarily living in one state but have permanent residence in another state where payday loans are legal. However, you will probably need to verify proof of address and not all lenders may be willing to take on your case.

If you are living in one state, you cannot take out a payday loan in a neighboring state, even if payday lending is legal in both states. This is due to the different laws regarding payday lending per state. As such, lenders can only provide loans to people in states in which they have a valid license. This should also be noted when looking for payday loans online.

What are the Legal Implications of Taking Out a Payday Loan in Prohibited States?

When taking out a loan, you must always check if it is prohibited in your state. This includes checking the interest rates and fees, loan amount and loan terms to see if it is valid within your state’s legislation. If you find out that the payday loan you took out was illegal, you may not need to pay it back. Whilst some states require you to pay back the agreed amount (including interest), in others you are only required to repay the principal. To find out this information, you will need to contact your state’s consumer protection office. They can advise about the legality of short-term lending in your state.

If you move to a different state after taking out a loan in another state, you will still be required to pay back the loan in full with the agreed interest rate, even if payday loans are illegal in your new state. If you do not pay this back, you are at risk of being sued by the payday loan company.

If you are having short-term financial problems, there are other options available apart from payday loans.

What are Some Payday Loan Alternatives?

Just because payday loans are prohibited in your state, does not mean it is the end of the story for borrowing money. There are many other solutions available for short-term financial problems.

Personal loans

A personal loan is a form of credit which can help you with any big payments or to consolidate any high-interest debts. They are associated with having lower interest rates than credit cards. For this reason, they are often used to consolidate credit card debts into a more manageable, low-cost monthly payment. When seeking personal loans, check that your lender reports to the major credit bureaus to verify legitimacy. Paying back loan payments on time can help you build your credit core and subsequently apply for loans with better rates.

Installment loans

Installment loans are a type of short-term loan which can cover any payments which may occur between paychecks. As such, they are a good alternative for payday loans. Installment loans often provide a bit more flexibility in that you have longer to pay them back – not immediately when you receive your next paycheck. Additionally, they are less likely to be governed by strict state laws.

Tribal Lenders

Native American tribes, or payday lenders collaborating with these tribes, can offer payday lending in states where these types of loans may otherwise be illegal. They are generally considered to be a safe option; however, sometimes they incur very high interest rates.

Credit counselling

If you have mounting debts and are in a spiral of financial problems, credit counselling may be a good option for tackling more long-term issues. Through credit counselling, you can develop a realistic budget and receive guidance for building a savings account.

Paycheck advance

Depending on your state and your company, you may be able to advance your pay. If you are struggling to pay bills or any unexpected payments between paychecks, it is worth speaking to your employer. In some cases, your employer can advance your pay (what you have earned up until that date) with no additional fees. See cash advances for more information.

If you are struggling between paychecks, you may be able to ask your employer for a pay advance

Can I Take Out Multiple Payday Loans Simultaneously?

To take out multiple payday loans at the same time will depend on the laws of your state. If legal, it is possible that you have already repaid a proportion of your existing loan before taking out a second one. Usually lenders will specify eligibility information within their policy or FAQ page. For some lenders, not only are multiple loans banned but even consecutive borrowing within a given time period. It is not recommendable to take out multiple payday loans as it makes you more likely to enter a spiral of debt.