- The age demographics of payday loan users are mostly Millennials and Gen-Xers

- 5.5% of Americans have used a payday loan in the last 5 years

- An average payday loan amount is $375

On average, 12 million American adults rely on payday loans every year representing a $9 billion industry in the United States. PEW Trusts carried out a study looking at key demographics and found that 5.5% of Americans across the entire country have used a payday loan in the last five years.

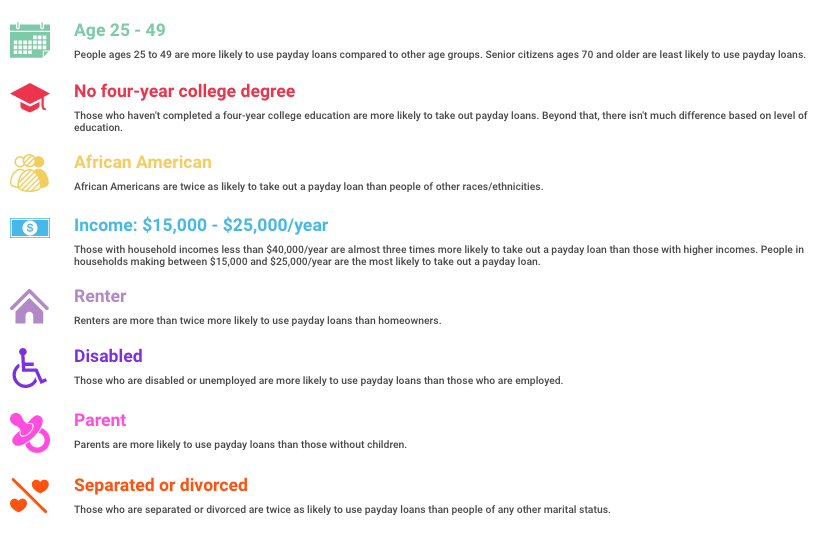

Borrower Demographics

2012 data shows that the majority of payday loan borrowers are white (55%), female (52%) and aged between 25 to 44 years old (52%).

According to the research by PEW Trusts, there are certain groups which are more likely to take out a payday loan. These are:

- Those with an annual income of below $40,000

- African Americans

- Home renters

- Those without a 4-year college degree

- Those who are separated or divorced

The average income of a payday loan borrower is $30,000 annually. Although low income is likely to increase the chances of needing to borrow money online , there are other factors which are more closely correlated.

Homeowners with a low income are less likely to take out a payday loan than renters with a higher income. In fact, 8% of renters earning between $40,000 to $100,000 compared to a 6% of homeowners earning between $15,000 and $40,000.

Typically, the average payday borrower is in debt five out of twelve months of the year.

The younger generation is one of the most likely demographics to take a payday loan (Finder.com)

Younger Generation Payday Borrowers

Although payday loans are used across generations, the most prevalent group is Millennials and Gen-Xers. The majority of these borrowers are aged 18-24 years old and one of the key reasons is mounting student debt. A 2018 survey by CNBC showed that nearly 40% of those 18-21 year olds and 51% of Millennial have considered a payday loan. Those aged 25-49 have used payday loans more than the rest of the general population. Those aged 70 years and older are the least likely to have used a payday loan.

Payday Loan Habits

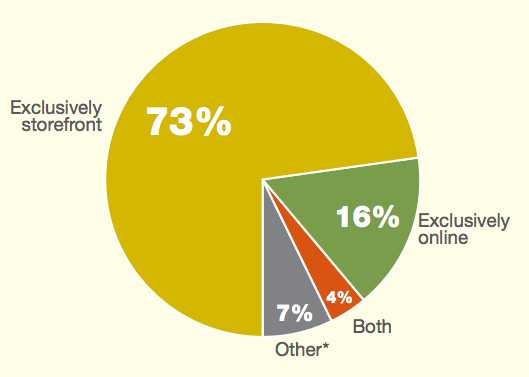

Demographics show that it is more habitual to take out a loan using storefront lenders rather than borrowing online. On average, around three-quarters of borrowers (73%) use storefront lenders to take out their loans with only around one-quarter borrowing online.

In 2017, there were already 14,348 payday loan stores across the United States. An average borrow users eight loans across the year, each lasting 18 days. This means that they have a payday loan for five out of twelve months of the year.

The majority of borrowers obtain their payday loans from payday loan stores (PEW Trusts)

How Much Do They Borrow?

The average loan size of a payday loan is $375 and the average borrower takes out 8 loans annually. Data from the CFPB shows that the majority of states permitting payday loans implementing a price cap on interest will end up being between $10 to $30 for every $100 borrowed. With a typical two-week payday loan, with an average $15 per $100 fee (15% interest), this can add up to an annual interest rate of around 400%.

How Much Do They Spend?

Due to the interest rate, and the nature of multiple consecutive payday loans, borrowers can end up spending much more than they borrow. For an average eight loans of $375 annually, borrowers look to spend $520 on interest each time. The average annual APR for payday loans is 396%. Subsequently, Americans spend around $4 billion annually on payday loan fees. Out of this, only 14% of borrowers are able to pay back their loans.

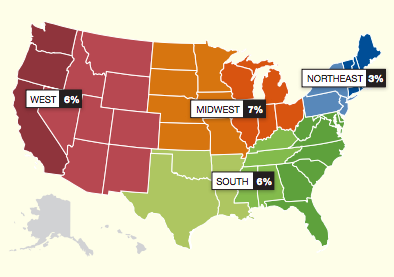

Where Do the Majority of Payday Loan Users live?

The demographics of payday users show that those in the southern states of the US are more likely to take out payday loans than other areas. By contrast, those in the northeast are least likely to take out payday loans. It is worth noting that this is largely governed by where payday loans are prohibited by law.

Those in urban cities are also more likely to take out payday loans. The states with the most and best payday lenders tend to be the ones with a larger population of minority or low-income citizens. These include South Dakota, New Mexico, Mississippi and Alabama. The states with the most lax laws subsequently have more payday lenders and thus more borrowers.

Payday loan usage is highest in parts of the South and Midwest (PEW Trust)

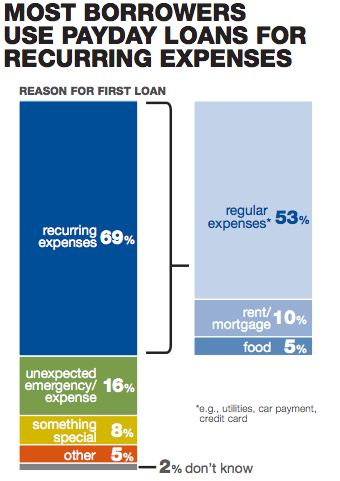

What Do they Use their Payday Loans for?

Although payday loans are advertised are a way to cover unexpected, short-term payments, the majority of payday loans are used to cover recurring payments and living expenses (7 in 10). The Consumer Financial Protection Bureau report that borrowers are most likely people who have fallen behind on their regular monthly expenses.

According the statistics, 69% used their payday loan to cover recurring expenses such as utilities, credit card bills, groceries, or to cover rent or mortgage payments. In fact, only 16% used their payday loan to cover an unexpected expense such as an emergency medical bill or car repair. For Millennials and Generation Z payday loans are often used for ongoing expenses including student loan payments and everyday transportation costs.

69% of payday loans are used to cover recurring expenses (PEW Trust)

How Many Payday Loans Do Borrowers Take Out?

58% of payday loan borrowers have trouble meeting monthly expenses. As such, it is common for borrowers to take out multiple loans in succession. An overwhelming majority (75%) of payday loans are taken out by someone who has previously taken out a payday loan. This is usually in fairly quick succession – 80% of payday loans are taken out within 2 weeks of paying off a previous loan. One fifth of borrowers end up taking 10 or more payday loans in succession. Similarly, one quarter of payday loans are rolled over 9 times or more.