- California has the greatest volume of payday lenders

- New Mexico is the state with the greatest volume of payday loan stores per capita

- The national average for payday loans is nearly 400% annually

A 2018 study from CBNC showed that one in ten Americans have used a payday loan. In the past two years, 11% of US adults (3,700 surveyed) have taken out a payday loan. With their ever-growing popularity, the majority of US states offer payday loans or other type of short-term loans. As such, payday loans represent a $9 billion business in the United States and are available in 36 states.

US States with the Most Payday Lenders

Some states, more than others, are more densely populated with payday loan stores (per capita). These tend to be the areas with have a higher percentage of poor and minority citizens. Within this list features Alabama, New Mexico, South Dakota and Mississippi. In terms of pure numbers, California has the greatest volume of payday lenders (2,451), closely followed by Texas (1,675). Conversely, Rhode Island has the least (5).

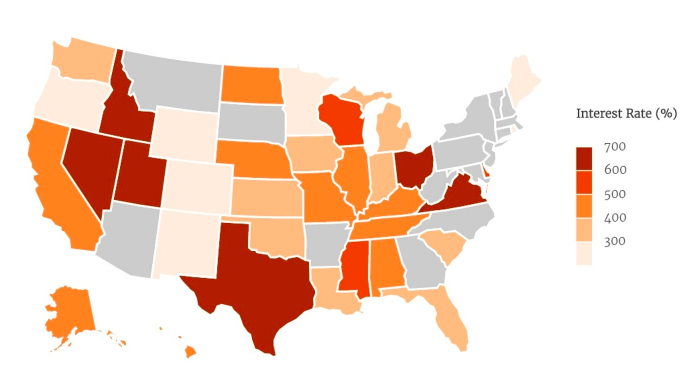

Payday Loan Interest Rates

The national average annual percentage rate for payday loans is nearly 400%. As a point of comparison, an average credit card APR in the US is 16.96% (data from CreditCards.com, July 2018). There is a great deal of variability between regions. In fact, in some regions borrowers pay twice as much for the same loans as in other regions. Consequently, many states have introduced interest rate limits to protect borrowers.

Map showing variability of interest rates across different states (CNBC)

States with the Highest Payday Loan Interest Rates

The US States with the highest interest rates for payday loans are Nevada, Ohio, Virginia, Utah, Texas and Idaho, all in excess of 600% interest rate per loan. Ohio has the highest payday loan rates in all of the US with an average interest rate of 667%.

States with the Lowest Payday Loan Interest Rates

The US States with the lowest interest rates are New Mexico and Oregon with an average interest rate of 175% and 154%, respectively. Areas with interest rate limits, such as Maine, Colorado and Minnesota, are known as being some of the lowest interest rates in the country.

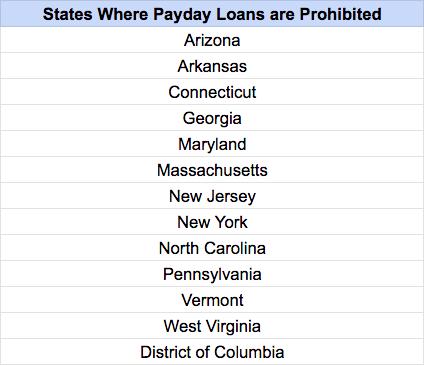

Which States Do Not Offer Payday Loans?

There are some places in which payday loans are prohibited. These are Arizona, Arkansas, Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont, West Virginia, and the District of Columbia. There are some zones which, although not explicitly outlawing payday loans, have specific laws regarding these types of funds. Additionally, interest rates and their terms vary between areas. For example, in many New England states, it is illegal to charge more than 300 to 1000% interest on any loan. Thus, whichever state you are in, it is worth checking the state policy.

Table showing the states in which payday loans are prohibited.